Interband & Quantum Cascade Lasers: Technologies, Market Trends and Applications (2021)

Will Cascade Lasers finally cause a market disruption?

SEE THE FLYER

Report outline

- 247 slides (PDF)

- € 4 990 – multi users license

Key Features of the report

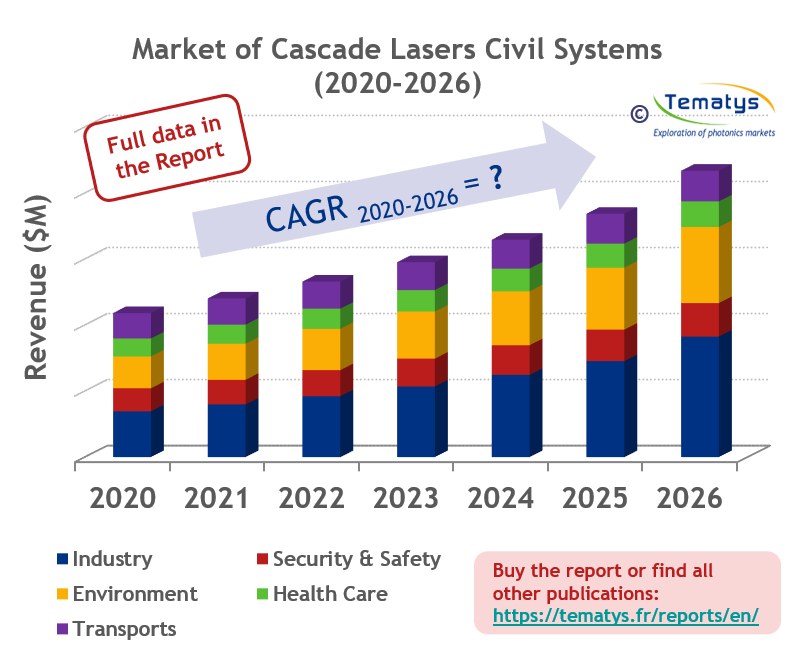

- Revenues of the ICLs and QCLs markets at the level of sources and systems

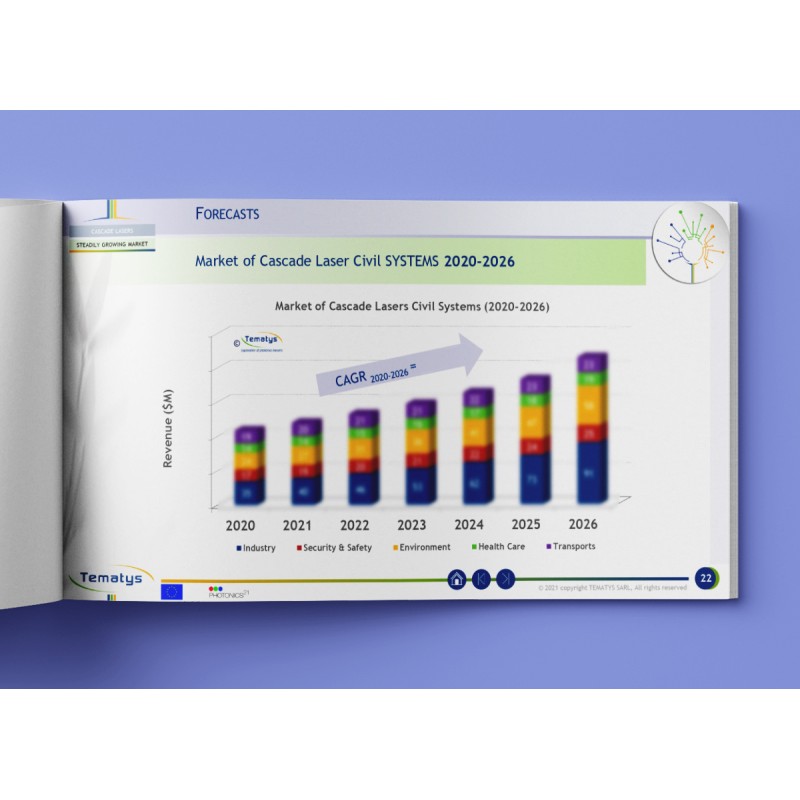

- Market forecasts up to 2026

- Comprehensive overview of ICL and QCL products and their applications at the level of sources and equipment (excluding THz range)

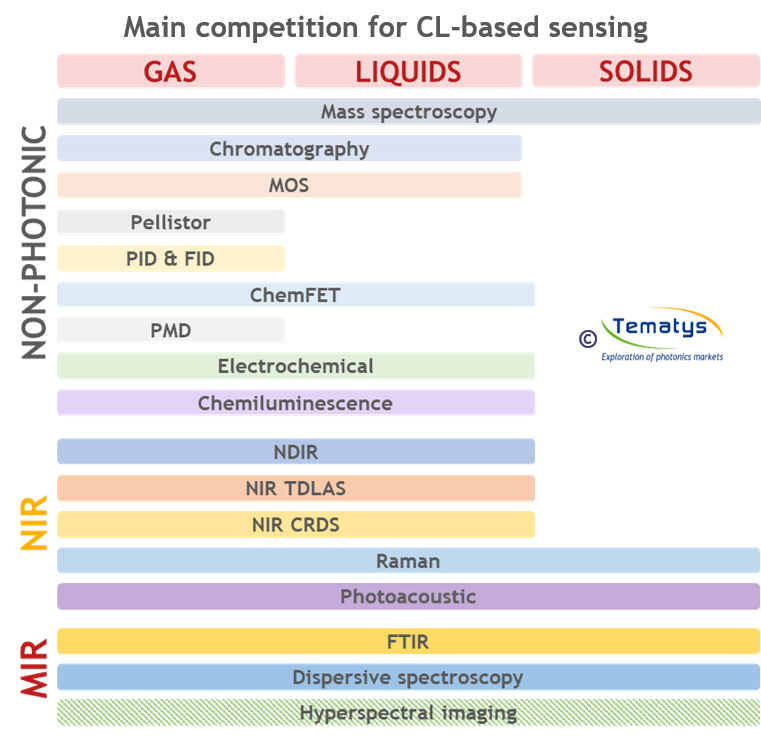

- Comparison of ICL and QCL-based equipment with the other competitive systems

- Business models analysis

- Identification of challenges and bottlenecks for the broader adoption of ICLs and QCLs in large volume applications

- Review of the recent application trends (with the focus on gas spectroscopy)

- Review of potentially attractive applications for ICLs and QCLs

Will Cascade Lasers finally cause a market disruption?

Interband and Quantum Cascade Lasers (ICLs and QCLs) offer coherent and high power radiation in the mid-infrared range, which is crucial for infrared countermeasures, high-resolution gas spectroscopy and chemical sensing.

Due to many advantages, Cascade Lasers were expected to mature quickly and to settle in large volume applications. Especially the semiconductor nature of ICLs and QCLs gave hope to make this technology largely scalable and cheap, as it happened with LEDs and VCSELs in the past.

Dynamic growth have not fully materialized in the last years. The price of lasers still remains high (around few thousand dollars per piece), and the

potentially “killer” applications have not come yet. Cascade Lasers can be mainly found in niche applications.

The reason for that lies both in the technical bottlenecks, but also in the market which has not been ready to implement CL technology. The customers were very conservative and there were many other competitive techniques to choose from. Now the perspectives for adoption are brighter.

All bottlenecks preventing the wider use of Cascade Laser technologies are deeply discussed in this Report. The study provides market forecasts from 2020 to 2026 and also describes all main players to answer the question if the market disruption can finally occur.

The need for “killer application”

Most of the ICL and QCL manufacturers interviewed for the purpose of this Report claim that the main bottleneck limiting a large Cascade Lasers market opening is lack of “killer application”. In their shared opinion the technological constraints are not as meaningful as the lack of big player that could incorporate Cascade Lasers in high volume sensors.

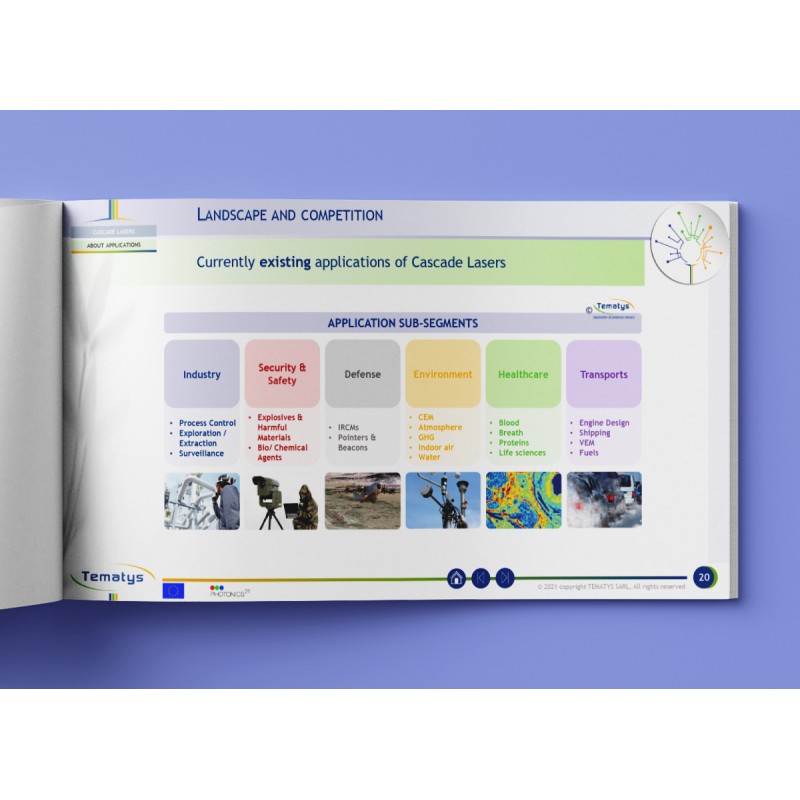

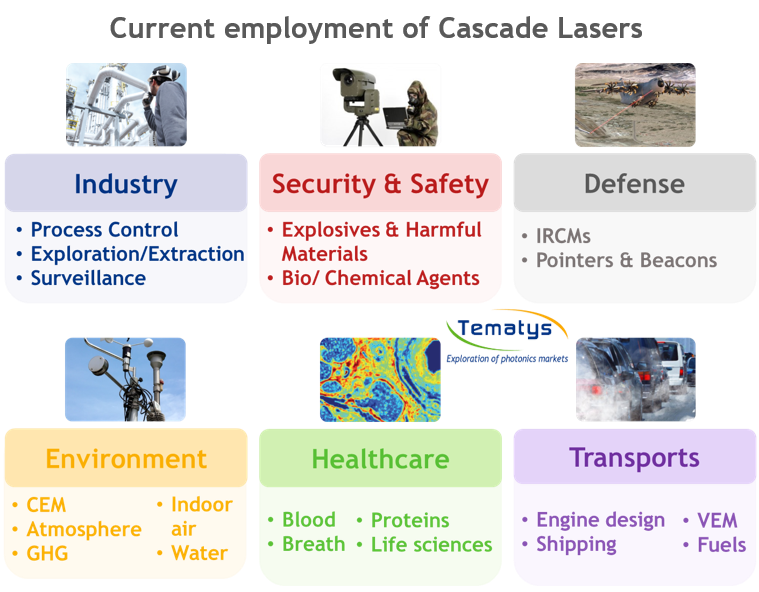

So far, ICLs and QCLs have been used in the following cases:

However, it has been reported that the ICLs and QCLs stand out from other photonic sources by their unique competitive advantages:

This report not only details why these features have not translated into large market success but also analyzes all promising applications that could finally make Cascade Laser technology widely used in the next years.

Many aspects have been studied to find these sectors: business and financial information of ICL- and QCL-related companies, overview of recent mergers and acquisitions on the laser and sensing market, examination of currently funded projects by the EU and US government in the field of Cascade Lasers and lasers, and revision of recently acknowledged patents. This allowed to draw a clear conclusions for the future of Cascade Lasers market.

Cost and size reduction

Cascade Lasers has been very well adopted in Industrial and Environment applications where they can offer fast in-line and on-line monitoring of main process control and pollution gases: CO, CO2, CH4, H2O, SOx, NOx etc. They are also vital in Defense use serving for modern countermeasure systems. However, the adoption in other analyzers is not as wide.

The report shows that the main issue behind that was related to cost and size. Footprint and weight of CL instruments has not been really reduced in the past years. In 2020 the average volume was still about 75 000 cm3 and the weight around 30-40 kg. That is why miniaturization of CL instruments is likely to be an inherent part of the broader adoption of CL systems.

Thread posed by growing competition

Until Cascade Lasers were developed, the mainstream mid-IR solution for spectroscopic applications was either FT-IR, which utilizes an interferometer plus white light derived from ceramics/ tungsten, or dispersive infrared spectroscopy, in which a diffraction grating is used. Recently, an IR-based photoacoustic detection is getting more and more was popularity.

However, there are also other non-photonic analyzers that grow and pose new thread for CL-based solutions. These are: NIR TDLAS, NIR CRDS, NDIR, Raman, ChemFET, MOS, chromatography, mass spectroscopy, PID/FID, Paramagnetic Detectors (PMD), Chemiluminescence, Pellistor, and Electrochemical sensing. There are also methods using 2D imaging instead of single point detection, the most common being hyperspectral imaging.

This Report compares ICL and QCL technologies with main competition in order to draw a proper market landscape for all recipients of the study.

ICL and QCL sources manufacturers mentioned in the report:

AdTech Optics, Alpes Lasers, Block Engineering, Daylight Solutions, Pendar Technologies, Hamamatsu Photonics, mirSense, Nanoplus GmbH, Pranalytica, IRGlare LLC, QuantaSpec, Thorlabs, Sumitomo Electric, Quantiox GmbH, Forward Photonics LLC, LD-PD INC, Intraband LLC, Sacher Lasertechnik, LongWave Photonics, Lytid, Akela Laser Corporation, VIGO System, Roithner Lasertechnik, U-Oplaz Technologies, Stratium Limited, IQE, Compound Semiconductor Technologies Global…

Providers of ICL and QCL-based equipment mentioned in the report:

RedShiftBio, Gasera, Bruker, Thermo Fisher, Emerson, Airoptic, Neoplas control, Northrop Grumman, LSE Monitors, Aerodyne Research, Physical Sciences Inc, Picarro, Quantared Technologies, Toshiba, Horiba, IRsweep, Eralytics, AP2E, AVL Emission Test Systems GmbH, LaserMaxDefence, Neo Monitors, Kittiwake Procal, Wavelengths Electronics, Diehl Defence, Los Gatos, Cemtek KVB-Enertec, Boreal Laser, Emsys Maritime Ltd, DiaMonTech AG, KNESTEL GmbH, Healthy Photon, MIRO Analytical Technologies AG, Leonardo DRS and many more…

Table of contents

Executive Summary

- Study goals and objectives

- Information sources and methodology

- Scope of the report

- Glossary

- Definitions

- List of companies mentioned in the report

- Inherent features

- Large expectations growing throughout the years

- Competitive market environment

- Market data

- Forecasts

- Solving the chicken and egg problem

- How do CLs work

- QCLs

- ICLs

- QCLs vs. ICLs

- Technological competition

- Components for systems

- Landscape and competition

- Techniques

- Segment description:

- Industry

- Security & Safety

- Defense

- Environment

- Healthcare

- Transports

6. Conclusions

7. Appendices

8. About TEMATYS